Real clients, real impact.

Mergers & Acquisitions

Coastal specializes in guiding portfolio companies through complex M&A integrations, carve-outs, and consolidations—aligning Salesforce with private equity investment strategies. With proven playbooks, we accelerate post-merger value capture by unifying customer data, streamlining sales processes, and standardizing reporting across newly combined entities.

Carve Outs

Carve-outs can leave portfolio companies with fragmented systems and limited infrastructure. Coastal quickly establishes a stand-alone Salesforce environment tailored to the new entity, ensuring data integrity, business continuity, and scalability from day one. Our proven playbooks accelerate separation, reduce disruption, and set the foundation for revenue growth and operational agility—so the new PortCo is positioned to deliver value faster.

Salesforce Org Consolidation

Coastal specializes in consolidating multiple Salesforce orgs into a single, unified platform. By harmonizing customer data, sales processes, and reporting, we enable newly combined companies to operate quickly as one organization.

Salesforce Org Performance Assessment

With Coastal’s Salesforce for Peak Performance Assessment, PE firms get a data-driven view of how a PortCo’s Salesforce org is performing—highlighting technical debt, scalability, and revenue system maturity. This insight enables fact-based investment decisions that maximize EBITDA impact.

Salesforce Optimization & Managed Services

Waves, our flexible managed services model, gives portfolio companies on-demand access to the Salesforce expertise they need—without the cost of building high-overhead teams in-house. Combined with our diagnostic frameworks and ongoing strategy sessions, we ensure Salesforce orgs are optimized, scalable platforms that deliver value across the investment cycle.

Revenue Optimization

As the #1-ranked Salesforce Revenue Cloud partner, Coastal delivers end-to-end quote-to-cash modernization—including CPQ-to-RCA migrations, billing, and subscription management—to eliminate revenue leakage. Our expertise helps PE firms systematically improve cash flow, expand margins, and increase the predictability of topline growth across their PortCos.

Agentforce & AI

Coastal helps portfolio companies safely and effectively adopt Agentforce AI by prioritizing initiatives based on value-creation impact, supported by strong governance, security, and alignment. By embedding AI into sales, service, and operations, we enable PE firms to capture productivity gains while minimizing the risks of ad hoc pilots and poor adoption.

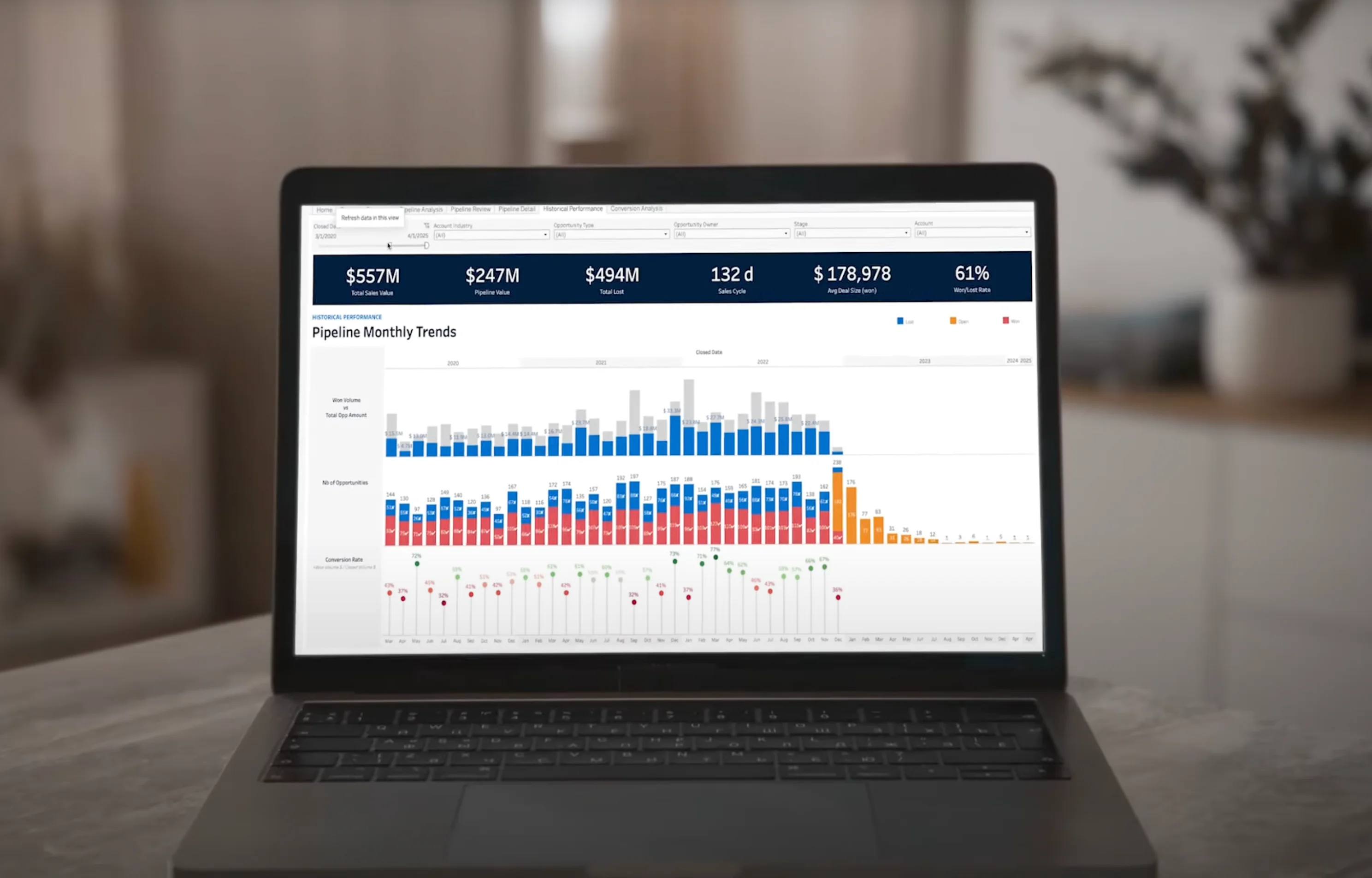

Data Modernization

Coastal’s Data Cloud and analytics services modernize portfolio company data architectures with governed, zero-copy models that unify insights across every system. For PE firms, this delivers a single source of truth for benchmarking, performance tracking, and rapid execution of value-creation strategies.

Expert

Customer 360

5/5

AppExchange Customer

Satisfaction Rating

7,903

Successfully Delivered

Projects

634

Multi-Cloud

Experts

Trusted solutions to common Private Equity challenges.

True North Value Creation Pack

Peak Performance Assessment

AI Data Cloud Assessment

CPQ to RCA Migration Assessment

Coastal’s combination of technical and business knowledge is where they really shine.

Actual Customer Review on G2