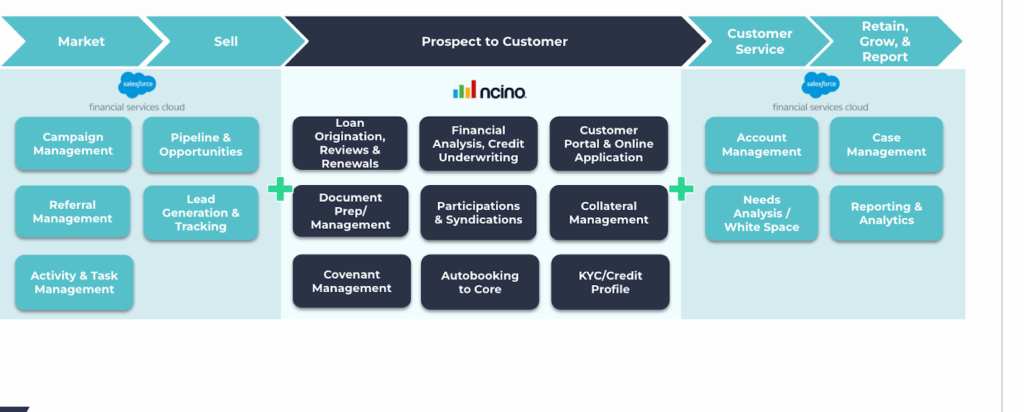

Your nCino implementation works. Your Salesforce Financial Services Cloud (FSC) functions. But you’re not using them together to drive asset growth or gain a complete view of customer interactions, making your processes feel disconnected.

You have the data and the tools. Yet the relationship data in your platform isn’t translating into new revenue or deposit growth.

Why Banks Leave Asset Growth on the Table with nCino and FSC

When you bought nCino, you also gained access to Salesforce Financial Services Cloud capabilities built to support growth beyond lending. But because nCino focuses primarily on loan origination, many institutions never fully explore FSC’s broader relationship management features. The functionality is there, but it typically falls outside the initial scope. Customers often don’t even realize that they have Salesforce.

The result: Your teams manage relationships through nCino’s lending-focused interface, but overlook FSC’s territory management, cross-sell automation, and Einstein forecasting capabilities that could drive deposit and fee income growth.

What Missing Growth Looks Like in Your nCino and FSC Setup

nCino captures lending customers’ touchpoints, credit decisions, and relationship changes—data designed for predictive relationship management. But most banks treat this as siloed information rather than bank-wide sales intelligence.

Meanwhile, Einstein sits unused. Pipeline Inspector collects dust. You’re paying for predictive tools while teams build Excel forecasts and manually track interactions that FSC could automate.

The specific gap: Loan maturity events should trigger automated cross-sell workflows. Customer deposit patterns should inform territory assignments. Credit decisions should feed Einstein’s relationship growth predictions. Instead, these insights stay trapped in operational reports.

The Compound Effect

Over time, workarounds calcify into standard procedure. Commercial teams spend hours on manual tracking while leadership makes portfolio decisions based on static reports instead of the predictive analytics they already own.

Every quarter, the gap between what you’re paying for and what you’re using widens. The longer you wait, the more expensive it becomes to fix, and competitors with integrated platforms get ahead.

Where the Growth Opportunity Lives

You need to connect nCino’s relationship data to FSC’s growth automation:

Configure what you own: Deploy FSC’s territory management and cross-sell workflows that complement nCino’s lending focus.

Activate predictive intelligence: Use Einstein to identify expansion opportunities based on actual relationship patterns, not demographic assumptions.

Automate the handoffs: Build workflows that turn loan events into deposit opportunities and credit decisions into relationship intelligence.

Coastal’s nCino + FSC Assessment

Our assessment identifies which FSC capabilities you’re missing, maps automation opportunities between nCino data and FSC workflows, and creates an implementation plan that gets more from your investment.

Phase 1: Team structure evaluation using Commercial Banker personas. Role clarity assessment. Current workflow documentation.

Phases 2-3: Technical review of your current setup—what’s configured, what’s not, and how your teams actually work. We assess Salesforce health, evaluate Einstein adoption, validate data flows between nCino and FSC, and identify manual workflows that could be automated.

Phase 4: Strategic roadmap with specific recommendations and implementation plan based on what we found. Architecture diagrams, gap analysis with technical fixes, and a sequenced implementation approach.

The ROI comes from getting more from existing investments rather than purchasing new platforms.

What You’ll Walk Away With

After our assessment, you’ll know:

- Which integration points need attention—and the best ways to fix them

- How to unlock growth capabilities that are already in your system

- What automation can be implemented without disrupting daily operations

- Where your biggest growth opportunities actually exist

No transformation promises. No perfect alignment vision. Just the technical roadmap to unlock the growth capabilities you already own while stopping the manual work that’s costing you revenue.

Get nCino and FSC Driving Growth Together

You already own the growth engine. The challenge is that nCino’s implementation approach doesn’t include the FSC configuration needed to unlock it.

Contact Coastal to schedule your FSC + nCino Assessment. This is a fast, focused diagnostic, not a drawn-out engagement. You’ll know what’s missing, what’s working, and where to act next.